Arm Holdings Plc (NASDAQ:ARM), the British semiconductor design company, has experienced a significant surge in its stock price, driven by its AI narrative and increased royalty fees. However, a leading research firm has issued a stark warning, predicting a potential 56% drop in the stock price.

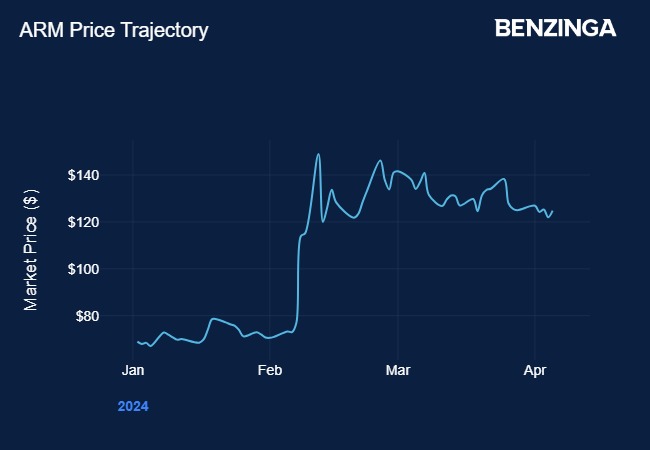

What Happened: Arm Holdings’ stock price has soared by over 80% this year, largely due to the company’s AI narrative and the rise in royalty fees following the launch of its latest chip architecture.

Morningstar, however, believes that the stock is overvalued and could plummet to $57, a 56% decrease from its current levels, CNBC reported.

See Also: Peter Schiff Warns Stocks Are In A ‘Stealth Bear Market’ As Gold Hits Record High

Despite acknowledging Arm Holdings’ strong execution and its AI growth, Morningstar considers the company’s AI story to be “ancillary” compared to that of Nvidia Corp., a major player in AI chip sales.

Morningstar’s price target for Arm Holdings reflects a 17% annual growth rate over the next decade and a top-end profit margin of 44%.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

The Other Side: Despite Morningstar’s bearish outlook, some experts believe that ARM’s position in the market, especially in the mobile CPU space, could lead to further revenue growth.

While Morningstar’s outlook is bearish, Mizuho Securities has taken a more optimistic stance, raising its price target for Arm Holdings to $160, representing a 24% upside from current levels.

The investment bank predicts a 25% annual revenue growth for Arm Holdings from 2025, significantly higher than Morningstar’s view.

EMJ Capital’s Eric Jackson named Arm Holdings as one of the less-talked-about AI stocks that he favors, highlighting the importance of the possibility of growing further instead of becoming skeptical about its prospects after a recent run-up in the stock prices.

“Mad Money” host Jim Cramer also highlighted Arm Holdings as an Nvidia-adjacent idea that investors can look at.

This indicates that while the AI narrative is driving Arm Holdings’ stock price, the company’s long-term prospects are still a topic of debate.

Price Action: On Tuesday, Arm Holdings’ stock was up 0.39% in premarket trading after closing at $129.25 on Monday, according to Benzinga Pro.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock