During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

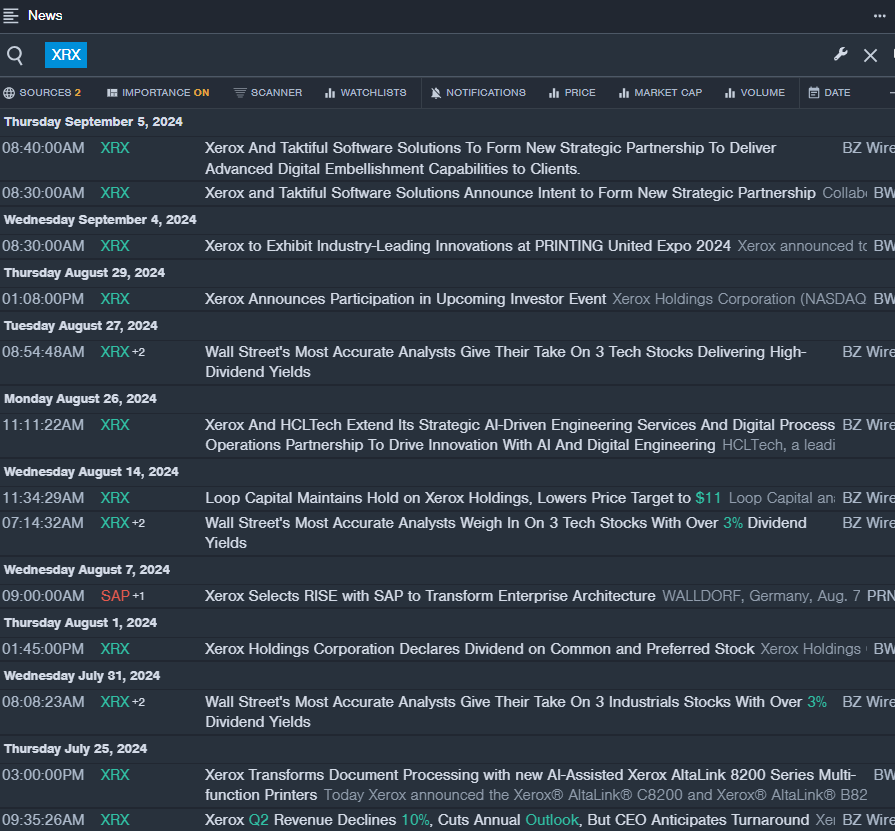

Xerox Holdings Corporation (NASDAQ:XRX)

- Dividend Yield: 9.77%

- Loop Capital analyst Ananda Baruah maintained a Hold rating and cut the price target from $14 to $11 on Aug. 14. This analyst has an accuracy rate of 76%.

- Citigroup analyst Asiya Merchant initiated coverage on the stock with a Sell rating and a price target of $11 on June 28. This analyst has an accuracy rate of 66%.

- Recent News: On Sept. 5, Xerox and Taktiful Software Solutions announced intent to form new strategic partnership.

- Benzinga Pro’s real-time newsfeed alerted to latest XRX news.

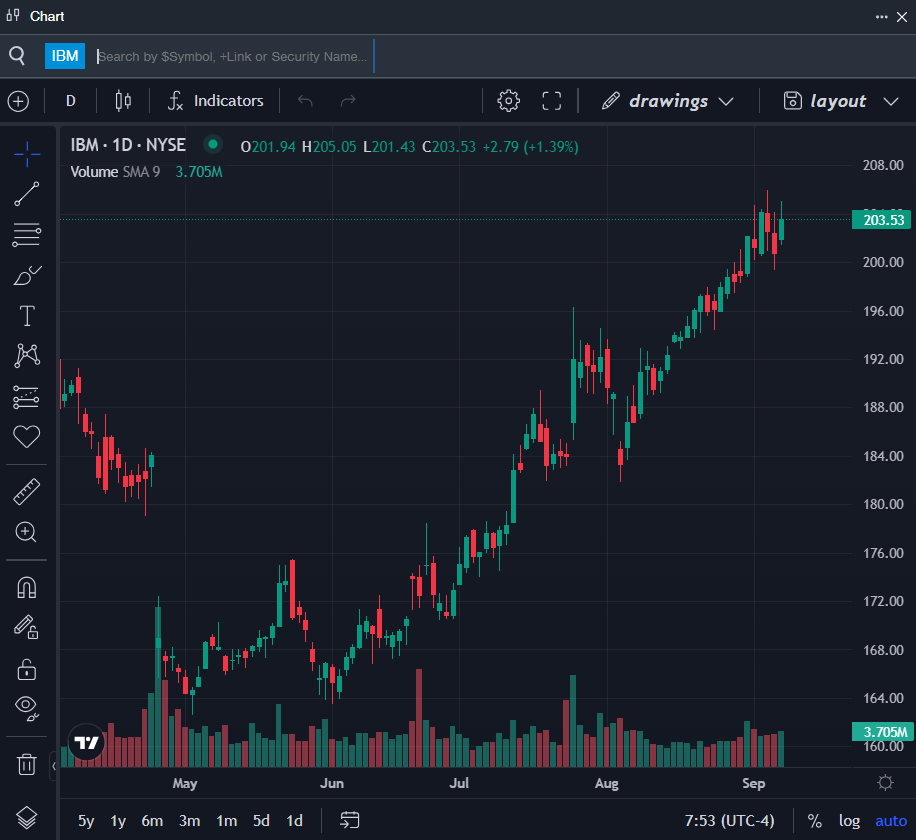

International Business Machines Corporation (NYSE:IBM)

- Dividend Yield: 3.28%

- UBS analyst David Vogt maintained a Sell rating and raised the price target from $130 to $145 on Sept. 4. This analyst has an accuracy rate of 72%.

- Jefferies analyst Brent Thill maintained a Hold rating and boosted the price target from $190 to $200 on July 25. This analyst has an accuracy rate of 78%.

- Recent News: On Sept. 9, IBM announced its intent to acquire Accelalpha, a global Oracle services provider.

- Benzinga Pro’s charting tool helped identify the trend in IBM stock.

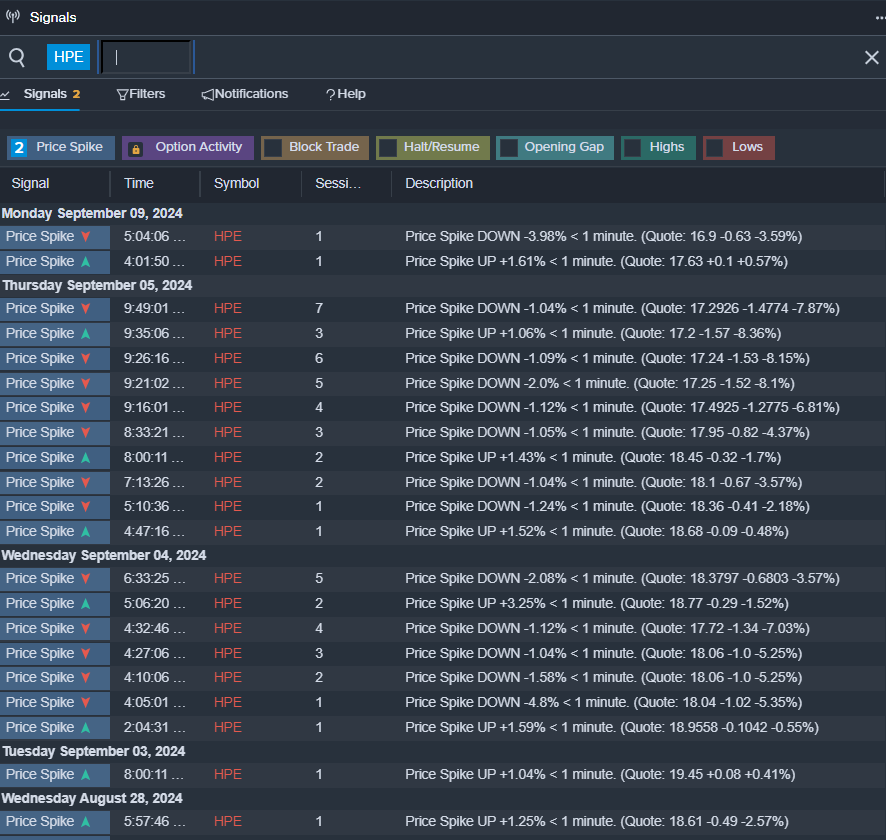

Hewlett Packard Enterprise Company (NYSE:HPE)

- Dividend Yield: 2.95%

- Loop Capital analyst Ananda Baruah maintained a Hold rating and raised the price target from $16 to $18 on Sept. 9. This analyst has an accuracy rate of 74%.

- B of A Securities analyst Wamsi Mohan maintained a Neutral rating and cut the price target from $24 to $21 on Sept. 5. This analyst has an accuracy rate of 74%.

- Recent News: On Sept. 9, Hewlett Packard Enterprise announced it has commenced a public offering of $1.35 billion of Series C mandatory convertible preferred stock.

- Benzinga Pro’s signals feature notified of a potential breakout in HPE shares.

Read More: