The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

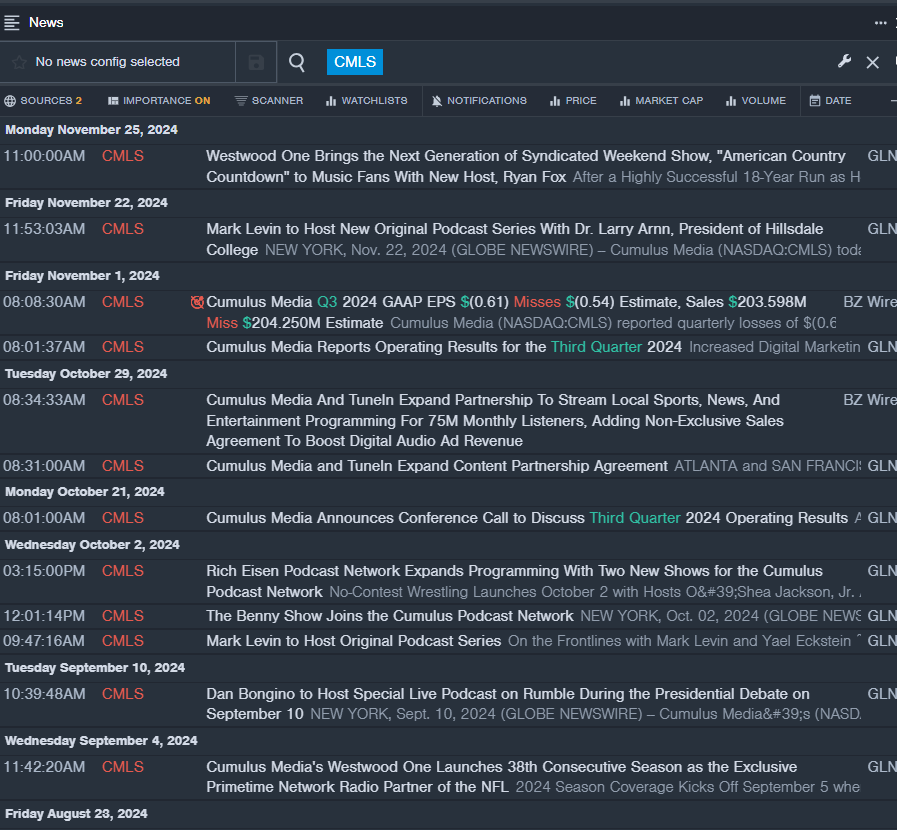

Cumulus Media Inc (NASDAQ:CMLS)

- On Nov. 1, Cumulus Media posted worse-than-expected third-quarter results. Mary G. Berner, President and Chief Executive Officer of Cumulus Media, said, “During the third quarter, we delivered revenue and EBITDA in-line with pacing commentary and analyst estimates. Given the market challenges, we maintained our focus on what we can control. Specifically, we continued investing to drive growth in our digital businesses, including in digital marketing services which increased revenue nearly 40% in the quarter; capitalizing on areas of improvement in national and political ad spending; maximizing operating cash flow; and improving operating leverage through ongoing expense reductions.” The company’s stock fell around 42% over the past month and has a 52-week low of $0.70.

- RSI Value: 25.88

- CMLS Price Action: Shares of Cumulus Media fell 3.3% to close at $0.70 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest CMLS news.

Beasley Broadcast Group Inc (NASDAQ:BBGI)

- On Nov. 5, Beasley Broadcast Group reported a quarterly loss of $2.33 per share. Caroline Beasley, Chief Executive Officer, said, “Beasley delivered third quarter net revenue of $58.2 million and same-station revenue growth of 0.5%, driven by strong political advertising revenue and a 11.7% increase in same-station digital revenue. The ongoing success of our digital transformation strategy continues to serve as an important offset to continued challenges in the audio advertising spot market.” The company’s stock fell around 31% over the past month and has a 52-week low of $7.66.

- RSI Value: 23.76

- BBGI Price Action: Shares of Beasley Broadcast jumped 11.7% to close at $9.25 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in BBGI stock.

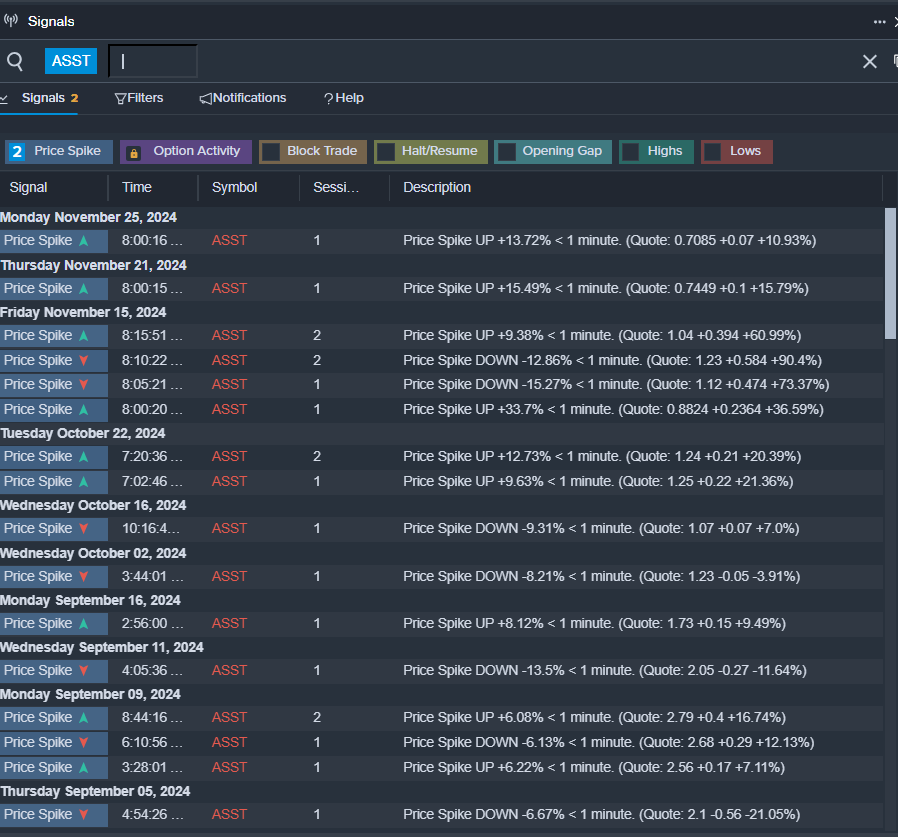

Asset Entities Inc (NASDAQ:ASST)

- On Nov. 15, Asset Entities reported third-quarter revenues of $202,921, representing a year-over-year increase from $60,135. “We are thrilled to see the strong year-over-year growth in revenue, with our recent strategic acquisitions and partnerships,” stated CEO Arshia Sarkhani. “We are optimistic for what’s ahead, as we continue executing strategic acquisitions, growth initiatives, and further collaborations and partnerships.” The company’s stock fell around 37% over the past month and has a 52-week low of $0.51.

- RSI Value: 24.21

- ASST Price Action: Shares of Asset Entities fell 9.9% to close at $0.58 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in ASST shares.

Read This Next: